Should I Stay or Should I Go?

29 March 2020

Not the time for panic selling

With most major stock markets down around 30 – 35% at the time of writing, many investors are probably left wondering whether they should stay in the markets or go to cash or something less risky.

Prior to the COVID-19 outbreak, markets were experiencing one of the longest bull markets in history, now many investors are left wondering where to next as we face an unprecedented moment in recent history.

The emotions we feel when markets are behaving like they are at the moment are completely normal and you can be forgiven for thinking investment markets are not for you or that you will be happy just having your money in the bank.

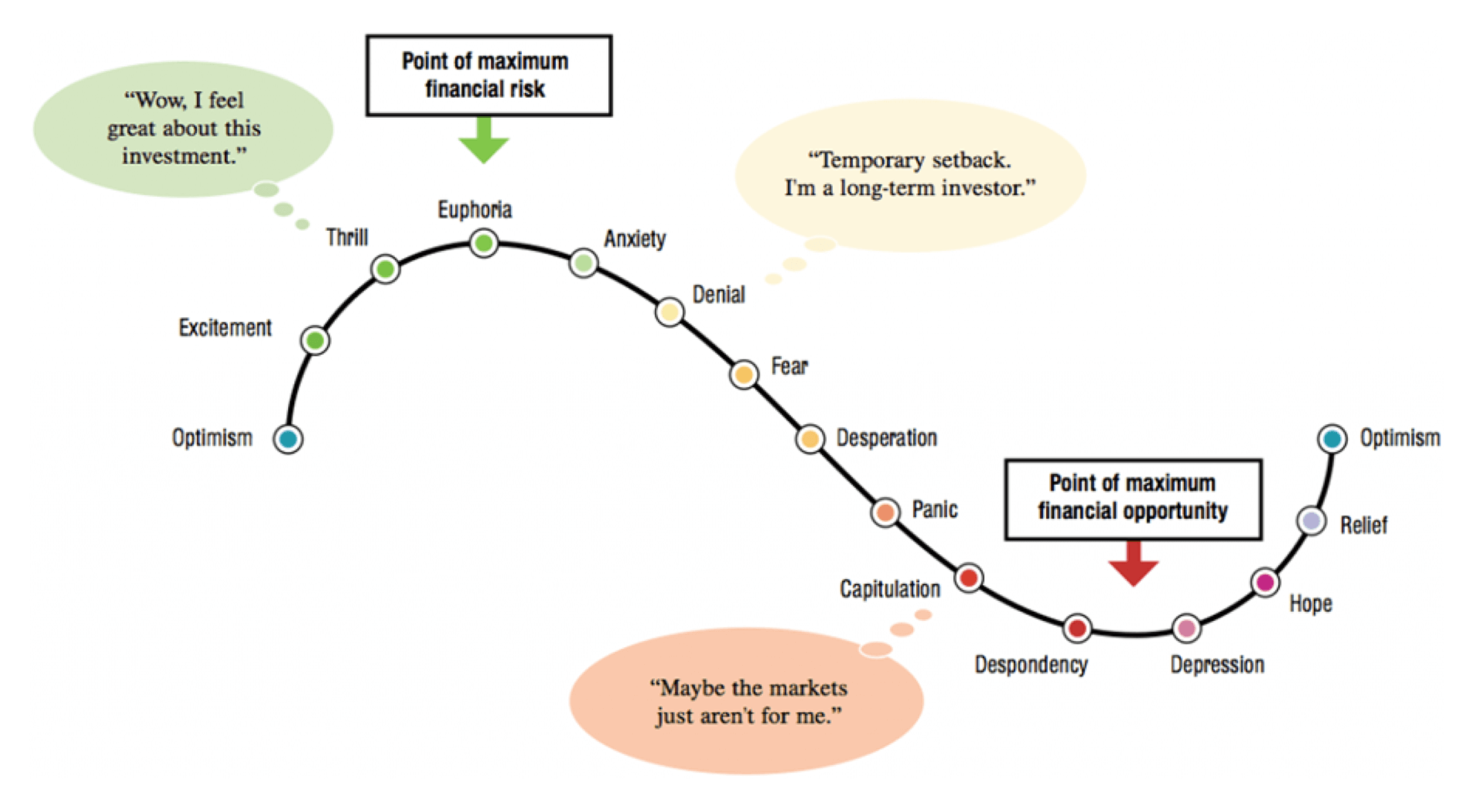

The cycle of market emotions graph below has been around for decades and through many market cycles. It simply explains how we are all feeling at different times of the market cycle, both when things are going well and when things are not, as we find ourselves in this period.

As you can see below, when we are feeling the emotion, “Capitulation” (selling and going to cash), this is nearing the bottom of the cycle and in many ways the wrong time to sell, as it is the “point of maximum financial opportunity”.

I will also point you to the top of the cycle, this is where we have all been over the past few years, a time when we have felt “Euphoria”

feeling how good the share market is, and how happy we feel about our investments, yet this was the time when we were at the maximum risk.

At InvestSense we are very aware of the market cycles and consequently, the portfolios have been well-diversified, also in most cases, we had less of your money exposed to expensive shares than many other investment portfolios in the market.

We also have allocations to cash and other non-share investments in the portfolio which we will look to deploy into the portfolio as we get closer to the bottom of the cycle “point of maximum financial opportunity”.

Generally, after share markets have had a large selloff, they tend to rebound quite strongly, this is why selling out of shares and moving into cash near the bottom of the cycle can be the worst action to take, especially when money in the bank is not even keeping up with inflation, in reality, the value of your money is going backwards.

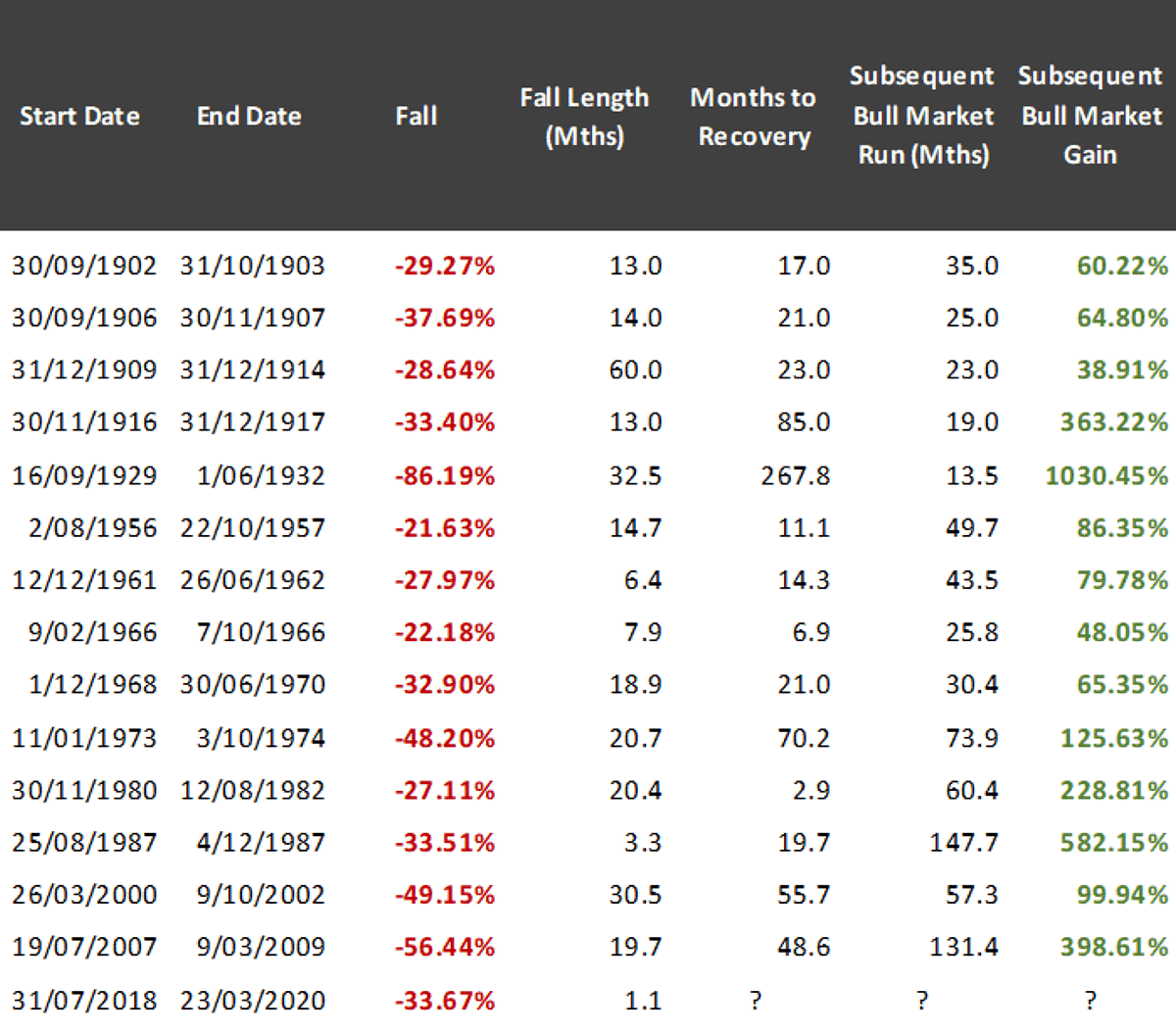

To help provide some context around how recoveries have played out historically, the chart below outlines some of the larger market falls that US equities experienced over the last 120 years and then how they have recovered. It can take some time to recover and this is where you will need to be patient.

To find out more about setting up a Mulcahy & Co Investment Account, please download the document below:

Latest News

Recovery support for people and communities affected by the Victorian fires that started on 7 January 2026. Victoria is facing severe bushfires throughout most of the state. A State of Disaster has been declared. Communities, farmers and businesses are facing heavy losses. The Victorian and Australian Governments are providing essential support to communities hit by the January bushfires. This aid will help with both immediate and long-term recovery needs. A summary of what if on offer is below: Financial Help for families Emergency Accommodation Long Term Recovery Help Clean-Up Help Help for Primary Producers and Farmers Counselling and Social Recovery Roads and community asset support Insurance Advice General Support Further information is available here: https://www.vic.gov.au/january-2026-victorian-bushfires

M Group Lending make Top 100 Broking Businesses list - nationwide. Our Lending team have been recognised in the Top 100 Mortgage Broking businesses through our aggregator LMG. This is an outstanding achievement as the list takes into account all mortgage broking businesses Australia wide. Well done to all our home loan brokers and their support team for their hard work and ultimate dedication to their clients! To chat to our team about your home loan, commercial loan or business loan needs - go to: www.mgroup.partners/lending-team