Stock of the Month: WPL

About

Woodside Petroleum is an Australian-based oil and gas company involved predominately in the exploration, production and shipping of oil and liquified natural gas (LNG).

Why is it in the portfolio

Woodside provides exposure to the oil and gas sector and is one of Australia’s largest listed companies. The company has a good mix of stable extraction facilities which deliver sustained income and exploration that offer potential growth in the future. Furthermore, we believe these growth prospects associated with specific projects are not being fully priced in and represent further upside potential.

What could go wrong

In recent years oil and gas prices have experienced drastic fluctuations, greatly impacting the profitability of companies like Woodside, and hence their share price. The price of oil, off of which many natural gas contracts are priced, is greatly influenced by OPEC+, a cartel of major producers whose decisions may be guided by geopolitical concerns rather than economic ones.

Furthermore, while Woodside has some high-quality assets, production is centred around large key projects; therefore, investors must be aware of operational risks that may potentially occur at any one of these key sites and which could have large impacts on cash flows.

Current Situation

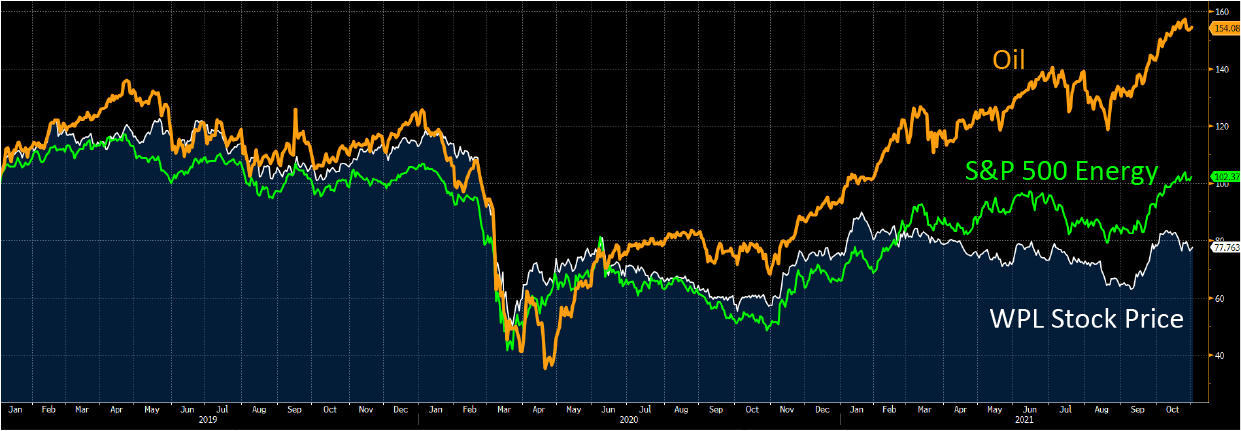

The price of oil is currently trading around US$84/barrel, marking an appreciation of 154% since the beginning of 2019, and an almost 4x increase from its COVID lows. Analysts point towards a combination of lingering supply restrictions in place by OPEC+, increasing global demand as economies rebound from COVID-19 and short-term supply disruptions following hurricanes in the Gulf of Mexico.

Source: Bloomberg, InvestSense

While the price of oil has climbed, WPL has stayed relatively flat after its COVID drawdown, moving more in-line with the S&P 500 energy sector. An odd occurrence given an increase in the oil price directly results in an increase in WPL’s earnings. The disconnect started in 2020, coinciding with the explosion of interest in ESG investing which has resulted in capital that would otherwise have been invested in WPL, going elsewhere. Accordingly, as WPL’s expected earnings have moved mostly in-line with the price of oil while its stock price has stayed flat, WPL’s expected earnings yield has greatly risen and the stock is trading at a very attractive valuation.

Although the world has begun to transition off fossil fuels, two factors could shield Woodside from being negatively impacted. For one, oil is predicted to be transitioned out first while natural gas will continue to be used as a cheap but not-too-dirty fuel source, to complement renewable energy sources and solve for the intermittent nature of their supply (i.e. when the sun doesn’t shine and the wind doesn’t blow). Second, experts agree that this transition will take many years to play out, and effects on demand are unlikely to be felt in the next 5 to 10 years.

Nevertheless, the focus on ESG and the threat of “stranded assets” has disincentivised Oil & Gas companies from re-investing in long-term, capital-intensive projects, with the result that global supply is now set to fall gradually over the coming years. By contrast, demand for oil and gas is predicted to continue to rise in the short-term as society continues to normalise and activities such as international travel rebound. This imbalance between rising or even flat demand and falling supply should logically lead to higher oil and gas prices, as has occurred so far this year.

Even if we disregard this positive outlook, at current levels, WPL’s high earnings will generate a high free cash flow yield that can either be reinvested to induce capital growth or paid out as dividends, either way benefitting investors. It is this “asymmetric payoff” that makes WPL particularly attractive in our opinion: even if oil prices stagnate or fall a bit, WPL’s high earnings should lead to a higher share price. But if oil prices continue to increase, the share price could experience even greater upside from current levels.

~ The Mulcahy & Co Financial Planning Team

Disclaimer: The information on this website is for general information only.

It should not be taken as constituting professional advice from the website owner – Mulcahy & Co Financial Planning. You should consider seeking independent legal, financial, taxation or other advice to check how the website information relates to your unique circumstances.

Latest News