Stock of the Month: MFG

About

Magellan Financial Group is a funds management firm that specialises in global equities and global listed infrastructure strategies for both retail and institutional clients. The company has also acquired Airlie Funds Management which is a boutique Australian equity investment company.

Long term thesis: Why is it in the portfolio

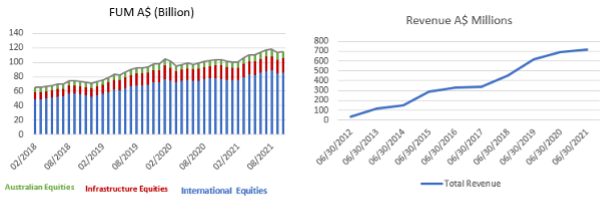

Magellan has experienced a strong run of funds under management (FUM) growth and more recently announced a range of growth strategies that aim to support the company further. This includes a highly anticipated retirement income product and giving guidance that there is more capacity in both their infrastructure and sustainable products. Magellan is likely to experience continued increase in flows, driven in part by the superannuation guarantee.

What could go wrong

Similar to other investment management peers, Magellan is subject to broad thematic risks, including decreasing FUM flows that lead to lower revenue, adverse movements in equity and foreign exchange markets that would in turn impact FUM, and periods of underperformance that can diminish Magellan’s ability to earn performance fees.

Current Situation

Since mid-2021, Magellan Financial Group has fallen out of favour with investors, declining from a yearly high of $56 per share on the 2nd of July to around ~$33 today. More recently, Magellan announced the resignation of CEO Brett Cairns who had been responsible for Magellan’s product innovation and overall business strategy. The string of negative news coupled with such a large drop in the share price (around -40%) is understandably alarming to even the most unwavering investors. However, once the full picture is revealed its easy to see why we’re sticking around.

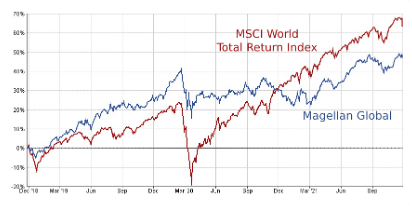

Magellan’s Global Equities strategy is the company’s biggest offering, both by FUM and revenue generated. The strategy was started at the beginning of 2007 and its main fund, the Magellan Global Fund, quickly became a marquee product in the Australian fund’s universe following a strong outperformance over the global financial crisis and ensuing years. However, the 2020 market correction brought on by COVID-19 turned out differently. Although the strategy minimized its downside during the crash, it failed to recover as fast as the index and has been lagging ever since.

The funds’ underperformance has resulted in modest outflows (circa $1.5bn) relative to their total FUM (over $110bn), but enough to stall revenue growth over the last few months. Investors being mainly concerned about future growth prospects; have revised down their expectations and consequently adapted their share price valuations.

Although this thesis is logical, it is predicated on the notion that Magellan will continue to have modest FUM growth in the future, and thus struggle to grow revenue at a pace reminiscent of its past success. While this is certainly a possibility, we believe the company is much more likely to return to high revenue growth levels for a variety of reasons.

For one, our experience has taught us that outperformance by fund managers tends to be cyclical. It is not surprising that after many years of beating the market, Hamish Douglas and his team are going through a more challenging time. Yet they remain a high calibre investment team (of which the departing CEO was not part of) and are as well placed as any to outperform over the coming years. If and when that happens, Magellan will start generating copious amounts of performance fees, none of which are currently priced in.

New potential sources of revenue are also not being accounted for. The aforementioned retirement income product is a creative solution to a problem that has so far baffled the funds management industry. Alongside Barclays, Magellan has also invested in Barrenjoey, a new investment bank venture. Taken together, these actions point to the ambition to grow Magellan into a sizable diversified financial services company, but none of this potential upside is reflected in the current share price.

On the other hand, the downside risk seems small. Even without FUM and revenue growth, Magellan is an extremely profitable business, with practically no debt, generating huge amounts of cash. The stock’s dividend yield has already ballooned up to an alluring 6.9%, giving investors a great source of income in an extremely low yield environment.

MFG currently trades at 13 times its future estimated earnings, down from about 30 times at its peak. We believe this constitutes a strong buying opportunity where the upside potential far outweighs the downside risk.

~ The Mulcahy & Co Financial Planning Team

Disclaimer: The information on this website is for general information only.

It should not be taken as constituting professional advice from the website owner – Mulcahy & Co Financial Planning. You should consider seeking independent legal, financial, taxation or other advice to check how the website information relates to your unique circumstances.

Latest News